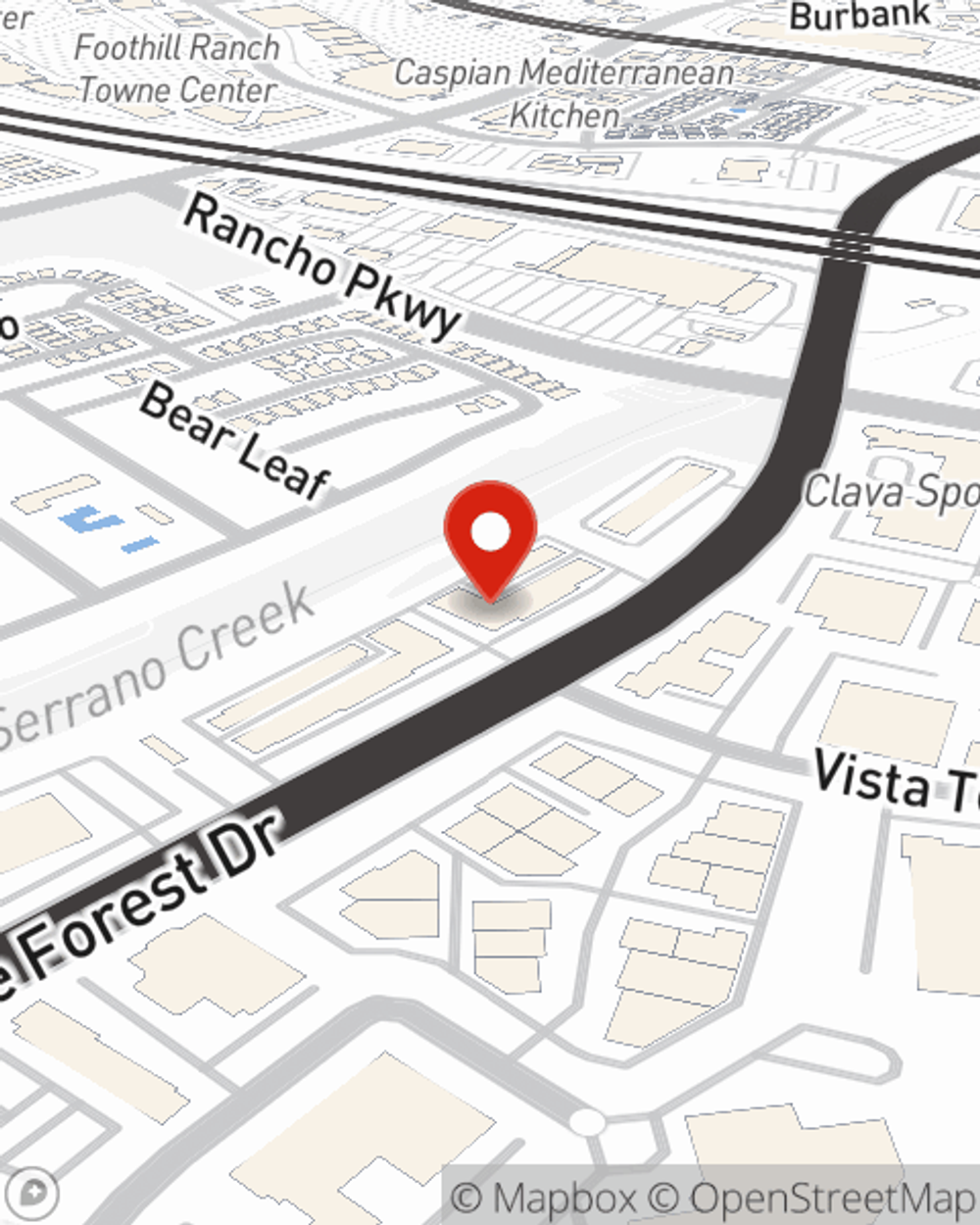

Life Insurance in and around Lake Forest

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

- Lake Forest

- Orange County

- Newport Beach

- Corona Del Mar

- Newport Coast

- Atherton

- Beverly Hills

- Santa Monica

- Palo Alto

- Pacific Palisades

- Westwood

- Triburon

- Brentwood

- San Marino

- Calabasas

- Westlake Village

- Dana Point

- Mission Viejo

It's Never Too Soon For Life Insurance

There's a common misconception that young people don't need Life insurance, but even if you are young and newly married, now could be the right time to start learning about Life insurance.

Protection for those you care about

What are you waiting for?

Lake Forest Chooses Life Insurance From State Farm

Life can be just as uncertain when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for coverage for a specific time frame or coverage for a specific number of years, State Farm can help you choose the right policy for you.

No matter where you are in life, you're still a person who could need life insurance. Get in touch with State Farm agent Bradley Purcell's office to find out the options that are right for you and those you hold dear.

Have More Questions About Life Insurance?

Call Bradley at (949) 203-3600 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Bradley Purcell

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.