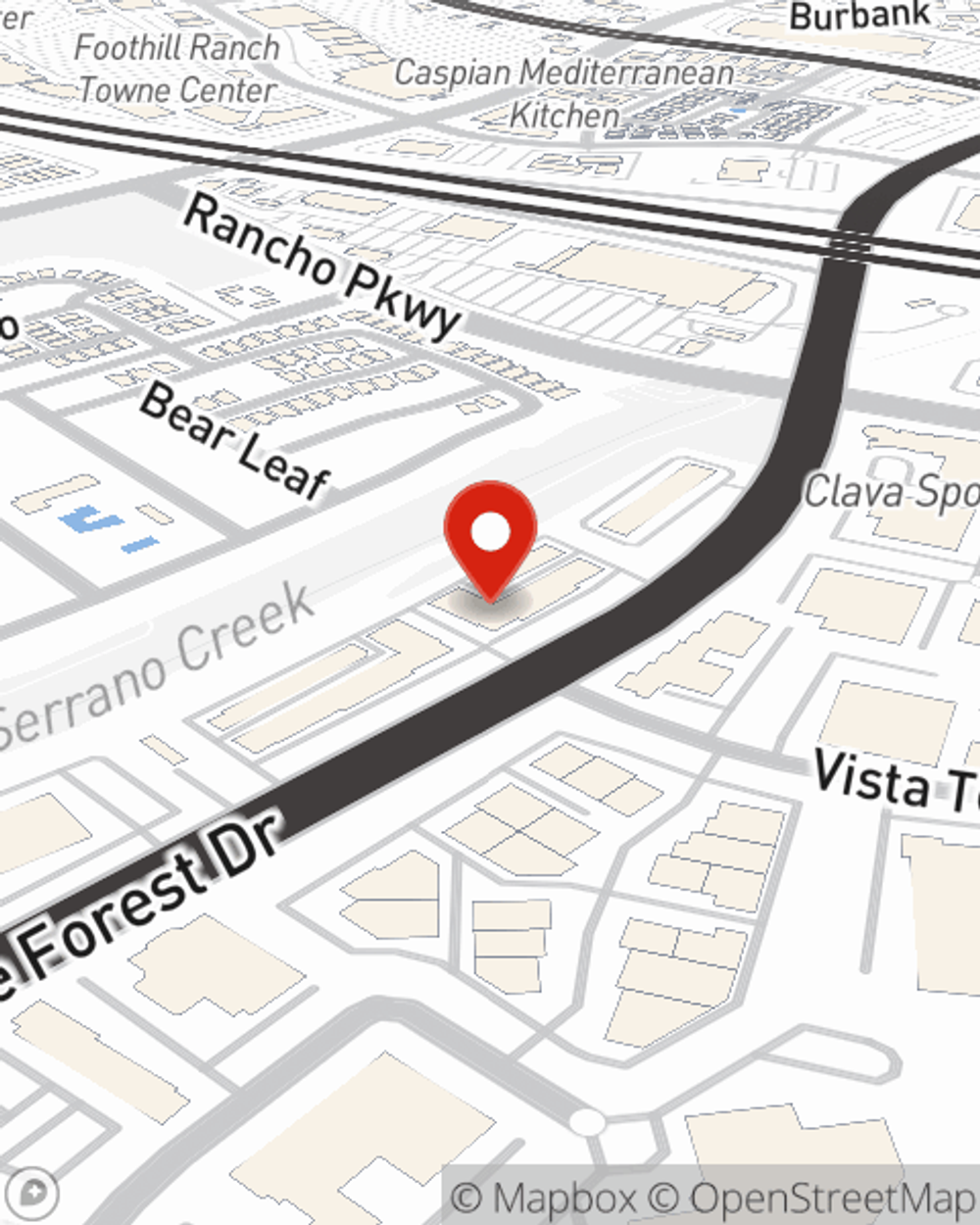

Renters Insurance in and around Lake Forest

Your renters insurance search is over, Lake Forest

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Lake Forest

- Orange County

- Newport Beach

- Corona Del Mar

- Newport Coast

- Atherton

- Beverly Hills

- Santa Monica

- Palo Alto

- Pacific Palisades

- Westwood

- Triburon

- Brentwood

- San Marino

- Calabasas

- Westlake Village

- Dana Point

- Mission Viejo

Insure What You Own While You Lease A Home

There are plenty of choices for renters insurance in Lake Forest. Sorting through savings options and providers to pick the right one isn’t easy. But if you want great priced renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy remarkable value and straightforward service by working with State Farm Agent Bradley Purcell. That’s because Bradley Purcell can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including jewelry, clothing, appliances, swing sets, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Bradley Purcell can be there to help whenever the unexpected happens, to get you back in your routine. State Farm provides you with insurance protection and is here to help!

Your renters insurance search is over, Lake Forest

Renters insurance can help protect your belongings

Why Renters In Lake Forest Choose State Farm

You may be doubtful that Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the home. How difficult it would be to replace your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when windstorms or tornadoes occur.

As a commited provider of renters insurance in Lake Forest, CA, State Farm aims to keep your home safe. Call State Farm agent Bradley Purcell today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Bradley at (949) 203-3600 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Bradley Purcell

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.